Still Processing Deals in the Dark Ages?

Article Highlights:

- Use the right technology to minimize errors.

- Limit tensions between departments by eliminating manual calculations.

There’s been a battle in your dealership since the dawn of time. It isn’t the haggling your sales staff go through with customers. It isn’t parts misquoting prices to service. It lurks in the hallway between F&I and accounting, and it’s affecting dealership morale every day. So what is it?

Imagine you are an F&I manager. You probably have a good idea of what will be on your paycheque because you know how much you’re making on each deal. You may earmark money for an upcoming vacation or plan on investing it. But when you get your paycheque, you realize, ‘Hey! I should’ve made more! This isn’t right!’ You march to the accounting office to discuss it. But the accounting office states you used the wrong rates for your deals and they had to change them all. Not their fault. . .

Or, imagine the scenario from a different perspective. Every time a deal comes into the accounting office, you sigh. You have to change the cost of the extended service or the amount of the rebate because, again, F&I used the incorrect ones. Because of this, you spend valuable time punching numbers on a calculator to adjust the deal information. Oh, and don’t forget to make sure what you have in accounting matches what’s in F&I!

Is either of these options ideal? Of course not. Employees in both departments are frustrated by this every day.

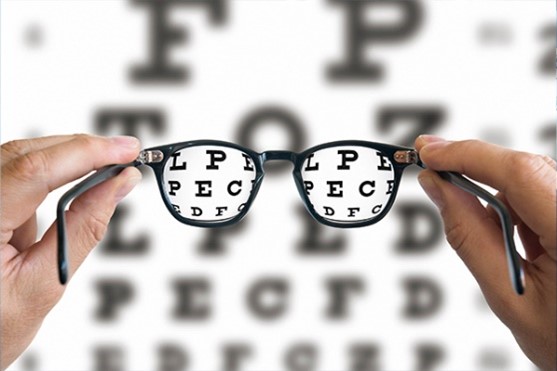

How much time is your staff wasting, tracking down the right information for deals and fixing the incorrect issues? Your office probably isn’t fixing errors on parchment paper by candlelight, but even with the right technology, if the information put into it is inaccurate, you’re going to spend a lot of time correcting mistakes.

Deal integration is a problem all dealerships have, but just because it’s the way it’s always been done doesn’t mean it’s the best way.

Wouldn’t it be valuable to your staff to have every deal transfer, completely and accurately, from F&I to accounting?

You need a system that allows for better deal integration between F&I and accounting. How can you do that?

- Ensure you have correct information in F&I.

- Eliminate the need to manually calculate amounts.

- Fix accounting mistakes for both accounting and F&I, not just one or the other.

By using a system with better deal integration and taking advantage of training opportunities, employees will be more efficient and happier at work. Give your employees the opportunity to step out of the dark ages of deal processing and into a technology-driven, efficiency-focused dealership.

Related Articles:

The days of “just browsing” are behind us. Today’s buyers show up with screenshots, side-by-side comparisons, and monthly payments already calculated. They’re ready to sign…

At its core, the desking process should be simple. But the reality is, if you ask ten dealerships how they desk deals, you’ll get ten…

It’s funny, the way your world opens up after you visit the eye doctor for the first time and learn you need glasses. I’ve been…

In response to a social media trend, there’s a chance someone asked you “How often do you think about the Roman Empire?” As a history…